September 13, 2023

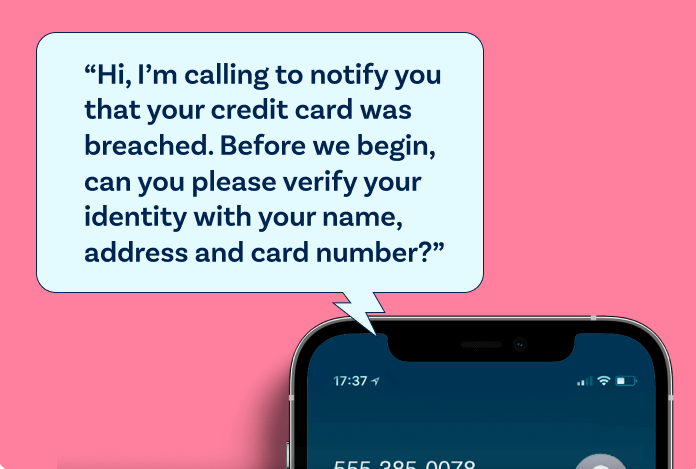

Fraudulent Phone Calls

How to Stay Safe from Phone Call Scams

Through its Banks Never Ask That campaign, the American Bankers Association offers a variety of tips to help consumers stay safe from phone call scams.

1. Don’t rely on caller ID.

Scammers can make any number or name appear on your caller ID. Even if your phone shows it’s your bank calling, it could be anyone. Always be wary of incoming calls.

2. Never give sensitive information.

Never share sensitive information like your bank password, PIN, or a one-time login code with someone who calls you unexpectedly — even if they say they’re from your bank. Banks may need to verify personal information if you call them, but never the other way around.

3. Watch out for a false sense of urgency.

Scammers count on getting you to act before you think, usually by including a threat. Banks never will. A scammer might say “act now or your account will be closed,” or even “we’ve detected suspicious activity on your account” — don’t give in to the pressure.

4. Hang up — even if it sounds legit.

Whether it’s a scammer impersonating your bank or a real call, stay safe by ending unexpected calls and dialing the number on the back of your bank card instead.

Contact your bank, financial institutions, and creditors.

- Speak with the fraud department and explain that someone has stolen your identity.

- Request to close or freeze any accounts that may have been tampered with or fraudulently established.

- Make sure to change your online login credentials, passwords, and PINs.

Secure your email and other communication accounts.

- Many people reuse passwords, and your email or cell phone account may be compromised as well.

- Immediately change your accounts’ passwords and implement multi-factor authentication — a setting that prevents cyber criminals from accessing your accounts, even if they know your password — if you haven’t already done so.

Check your credit reports and place a fraud alert on them.

- Get a free copy of your credit report from annualcreditreport.com or call 877.322.8228.

- Review your credit report to make sure unauthorized accounts have not been opened in your name.

- Report any fraudulent accounts to the appropriate financial institutions.

- Place a fraud alert on your credit by contacting one of the three credit bureaus. That company must tell the other two.

- Experian: 888.397.3742 or experian.com

- TransUnion: 800.680.7289 or transunion.com

- Equifax: 888.766.0008 or equifax.com

Contact ChexSystems at 888.478.6536 to place a security alert on the compromised checking and savings accounts when a deposit account has been impacted. Or, make your report to ChexSystems online.

Contact the Federal Trade Commission to report an ID theft incident: visit identitytheft.gov or call 877.438.4338.

File a report with your local law enforcement.

- Get a copy of the report to submit to your creditors and others that may require proof of the crime.